Mutual funds, a fundamental component of investment portfolios, present an avenue for diversified and expertly managed wealth expansion. Yet, understanding the intricacies of the accompanying fees is crucial. Among these, the front-end load stands out as a distinctive fee structure that warrants exploration. In this article, we delve into the intricacies of front-loaded mutual funds, understanding what front-end loads entail, their advantages and disadvantages, comparisons with other fee structures, and scenarios where they might be favorable.

What is a Front-End Load in Mutual Funds?

A front-end load, often known as a sales charge or load fee, is a commission that investors must pay at the outset of their investment in a mutual fund. Unlike ongoing operating expenses associated with fund management, front-end loads represent a one-time expense. This distinctive fee structure aims to compensate financial intermediaries, including brokers or financial advisors, for their integral role in directing investors toward appropriate funds.

How Front-End Load Works

The mechanics of a front-end load involve the allocation of a percentage of the total investment to cover the sales charge at the onset of the investment journey. To illustrate, envision a scenario where an investor commits to a front-end-loaded mutual fund with a 5% charge. In this case, on a $10,000 investment, $500 would be earmarked and deducted as a fee. Consequently, only $9,500 is effectively invested in the fund, with the deducted amount serving as compensation for the financial intermediaries facilitating the investment process.

This fee structure, while diminishing the initial capital deployed, is a critical component in the financial ecosystem, fostering a symbiotic relationship between investors and professionals who guide them through the complexities of mutual fund investments. Understanding the inner workings of front-end loads is fundamental for investors to make informed decisions tailored to their financial goals.

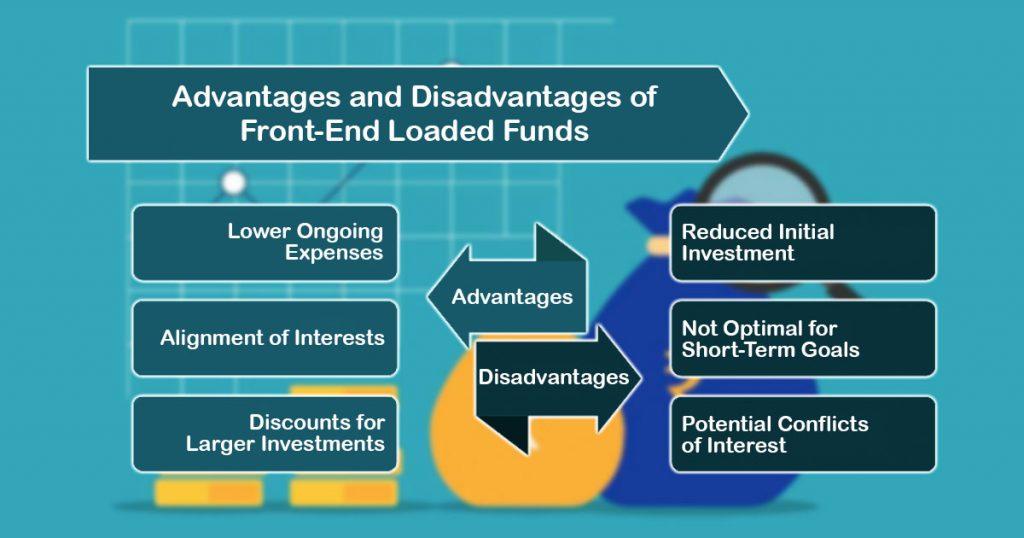

Advantages and Disadvantages of Front-End Loaded Funds

Advantages

- Lower Ongoing Expenses – Front-end loaded funds generally have lower ongoing fees and expense ratios compared to some other fee structures. This can benefit investors with a long-term focus who value continuous growth.

- Alignment of Interests – Investors gain from the guidance of financial experts navigating the intricate realm of mutual funds. The single front-end load harmonizes the interests of both investors and financial advisors.

- Discounts for Larger Investments – As the size of the investment grows, front-end loads are often discounted, making them more appealing for those planning substantial investments.

Disadvantages

- Reduced Initial Investment – The primary drawback is the reduction of the initial investment due to the front-end load. This diminished capital impacts the compounding effect on returns, especially for smaller investments.

- Not Optimal for Short-Term Goals – Front-end loaded funds may not be suitable for investors with short investment horizons. The time required to recoup the sales charge through realized earnings might outweigh the benefits.

- Potential Conflicts of Interest – Detractors contend that front-end loads could generate conflicts of interest, as financial advisors might have a motivation to suggest funds with higher loads, even if those might not be the optimal choice for the investor.

Other Fee Structures in Mutual Funds

Exploring the landscape of mutual fund fees extends beyond front-end loads, encompassing various structures that cater to different investor preferences and objectives.

1. Back-End Load (Contingent Deferred Sales Charge)

Back-end loads, alternatively termed contingent deferred sales charges (CDSC), function on a unique principle. Rather than imposing a fee at the time of the initial investment, investors face a commission when selling or redeeming shares. This fee structure aims to incentivize long-term commitments, aligning the interests of investors and fund managers. As the investor’s holding period extends, the back-end load typically decreases over time, often reaching zero after a specified period. This mechanism encourages a patient approach, rewarding investors for their enduring commitment to the fund.

2. Level Load (Annual Fees)

Level loads, characterized by fixed annual charges, represent an ongoing fee structure that investors encounter throughout their investment tenure. These charges, usually a percentage of the investment, cover management, marketing, and distribution expenses. Unlike front-end loads, which are one-time expenses, level loads persist annually, providing a predictable fee structure. Investors opting for level-loaded funds benefit from a consistent and transparent approach to expense management, allowing them to anticipate costs associated with their mutual fund investments.

3. No-Load Funds

In contrast to front-end loaded and back-end loaded funds, no-load funds distinguish themselves by not charging sales commissions at the time of purchase or redemption. However, it is crucial to emphasize that the lack of initial charges does not imply investing without fees. No-load funds might still apply additional charges, including management fees or 12b-1 fees, addressing marketing and distribution expenses. Investors engaging with no-load funds often require a disciplined approach, as the absence of upfront fees might tempt them to engage in more frequent trading. Staying invested for the long term becomes crucial to offset potential fees and maximize returns.

How Does Front-End Loaded Compare to Other Fee Structures?

Comparing front-end loads with other fee structures is crucial for making informed investment decisions:

- Expense Ratios – Front-end loaded funds often have lower expense ratios than some no-load funds, making them attractive for long-term investors.

- Compounded Impact – The decrease in the initial investment resulting from front-end loads can compound over time, affecting the overall cost of owning the fund.

- Investment Horizon – The suitability of front-end loaded funds depends on the investor’s time horizon. Long-term investors may find the lower ongoing expenses offset the upfront sales charge.

Front-End Loaded in Mutual Fund May Be Good in Certain Scenarios

In conclusion, while front-end-loaded mutual funds may seem counterintuitive at first glance, they can be advantageous in specific scenarios. Long-term investors benefit from lower ongoing expenses, personalized guidance from financial professionals, and potential discounts for larger investments.

However, the decision to opt for front-end loaded funds ultimately rests on individual circumstances, investment goals, and the investor’s willingness to navigate potential conflicts of interest. Comprehending the intricacies of front-end loads empowers investors to make informed decisions in harmony with their financial goals. Front-end loaded mutual funds, when strategically chosen, can play a valuable role in a well-diversified and goal-oriented investment portfolio.